Time-pressed, foodie and health-focused consumers are constantly looking for ways to get the produce they want and need, when they want and need it. We see the produce industry — and disruptors — adjusting to, adapting and pushing these trends. It does this by providing locally sourced product, adopting traceability protocols and implementing new scanning and delivery technologies at the retail stage.

Consumer demand is high for food fitting a specific niche or diet, such as local, organic, vegetarian, vegan, paleo and peanut-free. Gluten-free is one example of a food trend of the diet-conscious consumer. In 2016, Jama Internal Medicine published an article, based on research performed between 2009 and 2014, that showed more people are embracing gluten-free diets, although the presence of celiac disease has remained steady over that same timeframe.

Many retailers have capitalized on customers’ requests for easy access to produce through grocery delivery. Amazon’s delivery service, AmazonFresh, sells perishable and nonperishable products to customers in select U.S. states and certain cities worldwide, accommodating the time constraints of busy consumers. Walmart launched its own Grocery Delivery service in 2018; the service is available in more than 800 stores, and in January, the retailer announced plans to add 800 more in 2019.

We kept a watchful eye on customer markets as we compiled Produce Grower’s 2018 State of the Industry Report, while providing produce growers with the latest statistics about production space, growing systems, pests and diseases and more. In the following pages, learn how controlled environment agriculture fared in 2018.

How we did it

The data on these pages was collected via an online survey from July 30 to August 11, 2018.

The survey was closed for tabulation with 224 responses. To best represent the audience of interest, the results in the report were based on the 115 respondents who indicated that they work for an operation that grows finished produce and/or edible crop transplants under cover.

The response was tabulated and a report was prepared by Produce Grower’s editorial staff in accordance with accepted research standards and practices.

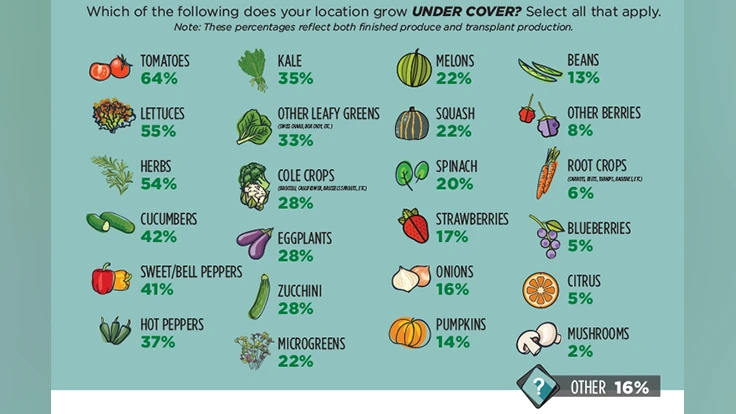

Crops that saw increases in 2018 included lettuces, which were up 4%; and microgreens, which were up 2%. Other leafy greens kept pace with 2017.

Meanwhile, there had been a decline in the number of common greenhouse fruiting crops being grown — tomatoes, cucumbers and eggplants. Compared to last year’s numbers, the number of grower respondents who produce these crops decreased by 19%, 23% and 21%, respectively.

Switches from large vining, fruiting crops to more lettuces and leafy greens reflect a change to produce that is a cornerstone of various trendy diets. What’s more, lettuce and leafy greens have a shorter turnaround and earlier harvest time than tomatoes, cucumbers and eggplants, so growers can more frequently sell these crops to retailers and consumers who constantly demand local and fresh product.

Direct-to-consumer sales of finished produce increased 4%, sales of finished produce to grocery food store retailers increased 14% and sales of finished produce to mass merchants increased 6%, from 2017. These increases, along with an 18% increase in the sale of finished produce to restaurants, suggest shifts in catering to more customers’ individual wants and needs and to the types of retailers that respond to those preferences via personalized offerings.

A sizable percentage of grower respondents (26%) said they do not have transplant customers. Meanwhile, edible crop transplant direct-to-consumer sales decreased 8% from last year. It is possible that more end-consumers would rather purchase finished produce than grow their own.

Sales of both edible crop transplants and finished produce to independent garden centers have remained steady over the past year. In 2012, edibles accounted for 27% of increases in sales at garden centers, but in 2017, that number dropped to 8% as sales of succulents grew, according to sister publication Garden Center magazine’s 2017 State of the Industry Report. However, this could reflect an increased demand for trendy ornamental crops at IGCs just as much as it could be a decreased demand for produce.

Explore the March 2019 Issue

Check out more from this issue and find your next story to read.

Latest from Greenhouse Management

- Meet the Next Gen: Gabriella Blair, Star Roses and Plants

- Leading Women of Horticulture: Katie Dubow, Garden Media Group, and Aubry Field, Lizzy Blossom

- Showing up at your horticulture business as your whole self

- Leading women of Greenhouse Management

- USDA fires experts on invasive pests, including Asian citrus psyllid, chilli thrips

- Farwest Show calls for 2025 New Varieties Showcase entries

- Leading Women of Horticulture: Arden Pontasch, North Creek Nurseries

- Leading Women of Horticulture: Emily Showalter, Willoway Nurseries