Pricing decisions are among the most difficult marketing-related decisions for a greenhouse company. The greenhouse manager must determine and set prices that not only cover their total costs and make a profit, but are also set at a level that will stimulate demand/sales and capture the full willingness-to-pay attitude on the part of customers.

Pricing decisions are among the most difficult marketing-related decisions for a greenhouse company. The greenhouse manager must determine and set prices that not only cover their total costs and make a profit, but are also set at a level that will stimulate demand/sales and capture the full willingness-to-pay attitude on the part of customers.

Let’s start with costs. There are different approaches to cost accounting. The cost per-square-foot model is the formula we’ve been talking about as an industry for 20 years. It’s an important part of knowing your costs, but growers must make the proper adjustments to allocated overhead costs on a realistic basis.

The variable costs, such as pots, plugs, fertilizer and growing media, are not the issue. A grower writes a check for those items and know what they cost.

What growers need to better understand is how to allocate overhead costs.

One of the adjustments needed to allocate overhead costs is to consider shrinkage. If you have shrink and you started with 1,000 plants and have 900 left, you have to allocate the overhead costs over the 900 plants. You must account for the cost of shrink.

Also consider that not all greenhouse space is created equal – some is heated, some is not, for example. You’ve got to make adjustments for things like heated space. If you apply the same overhead factor to all types of space, you’re over-allocating to some and under-allocating to others.

|

Say no to discounting To thrive in today’s economy when priccing product, there’s more to consider than how much you have in the pot, the soil and the cuttings. Covering your costs is a good place to start, but not the only consideration. That’s a producer-only mentality, said Bridget Behe, horticulture professor at Michigan State University. Growers often resist raising prices out of fear of losing sales. Sales will decrease to an extent, but you can preserve profitability with a price increase, Behe said. Take some baby steps. Try raising prices for one genus or cultivar, not every item you grow and sell. Test the market’s reaction. “I’m suggesting a price increase of 2-5 percent, not an increase that would price you out of the market,” she said. “It’s just math. Look at selling 80 percent of your inventory at three different price points,” she said. Consider the alternative – discounting hurts profits. If a grower has 500 1-gallon containers to sell (at a cost of $1.29 each) and is considering a $4.99 price point, what is the break-even point? Total cost is $645 and break-even is calculated by dividing total cost by the price of $4.99. The grower breaks even when the 129th unit is sold and profits will be generated on the 130th unit sold. If all 500 plants were sold, total revenue would be 500 x $4.99 = $2,495, which gives the firm a profit of $1,850 or $2,495 - $645 = $1,850. If the profit goal was $1,600, the grower would only need to sell 450 units. But if the price was discounted 10 percent to $4.49, the grower would have to sell 144 units to break even, and all 500 plants would have to sell to reach a $1,600 profit. In Greenhouse Management’s State of the Industry research about one-third of respondents (30.3 percent) said price increases yielded “the best possible gain in retaining or improving profit margins.” If you missed it, see all the State of the Industry data beginning on page 20. |

Different types of crops must also be taken into consideration. For instance, hanging baskets don’t take up space on bench. Therefore how you allocate overhead costs to hanging baskets or outdoor crops is different than how you allocate those costs to crops on the bench.

Refining these overhead costs will give growers a more accurate measurement for the actual cost of that crop.

And when you have a more accurate measurement of costs, you can more accurately price your plants.

Price points

All of your costs (overhead, marketing, distribution, production requirements and raw materials) act as a price floor for the grower in terms of negotiating final price. That is, a grower should be pricing in such a way as to cover all (fixed and variable) costs per plant.

One very short-term strategy that some growers implement is referred to as a marginal pricing strategy: a price is charged that is high enough to cover variable costs and makes some contribution to overhead (but does not cover all it). In the long run, however, the grower must cover all costs to maintain profitability. Unfortunately, too many growers do not have a full and accurate accounting of true overhead costs, so they end up “living off of depreciation,” which means you’re out of business.

If price is the floor, then the price ceiling is flip side of the supply and demand equation. Price ceiling is what consumers are willing to pay. But the industry doesn’t get to that point because most don’t know what that price is.

If you do a good job differentiating a product in the marketplace, consumers will be willing to pay more for it. This industry hasn’t raised prices in a long time because of the recession.

Price elasticity

Price elasticity is a measure of how sensitive consumption (demand) is to price levels. A product with a price that is considered inelastic is one for which the demand will remain relatively stable when the price is raised or lowered. Usually this is because there are no or few substitute products, the product is a luxury good, it has a loyal following, or it possesses superior product attributes.

Of course, the opposite is true for products with an elastic demand – by lowering the price, gross margin (selling price minus cost of goods sold) is less, but volume increases. As long as price is not lowered below break-even levels, the increase in volume will offset the reduced gross margin and profitability will be enhanced.

This is, of course, the “Wal-Mart” model and works for commodity-type products only. There are few growers in the green industry that have the economies of scale necessary to exercise this pricing strategy.

Most who attempt it do so unsuccessfully because they usually either unknowingly lower the price below their break-even (because they do not know their true cost structure) or they find themselves caught in a situation of having made idiosyncratic investments to service large (e.g., box store) customers and must continue their course to pay the interest on that investment.

Price elasticity is also correlated with the total revenue for the business. For example, raising the price of a product will usually have two effects: (1) more revenue is generated per unit sold and (2) fewer units are sold.

To increase total revenue for the firm, we must decide which of the two effects is greater. When demand is inelastic, total revenue is more influenced by the higher price and increases as price increases.

When demand is elastic, total revenue is more influenced by the lower quantity and decreases as price increases.

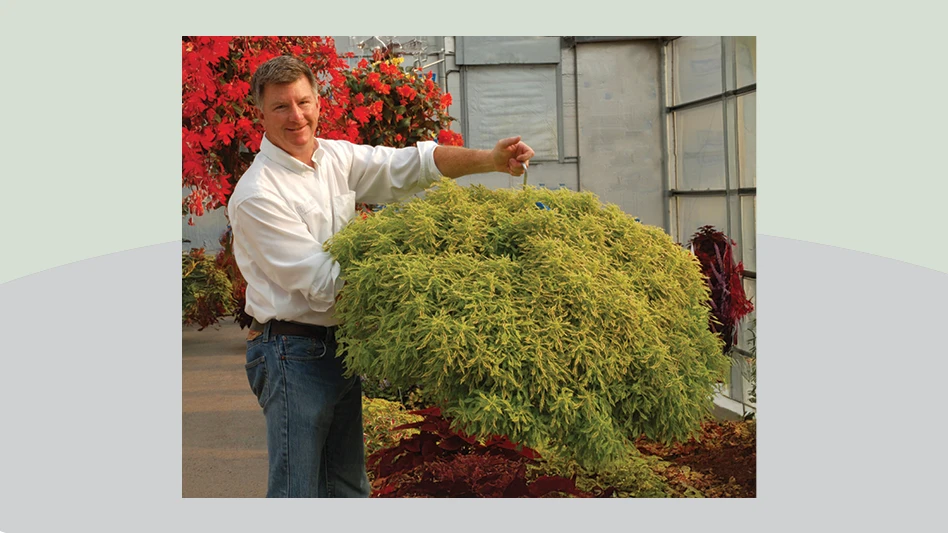

Charlie Hall is Ellison Chair in International Floriculture at Texas A&M; c-hall@tamu.edu.

Explore the October 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Greenhouse Management

- Happy holidays from the GIE Media Horticulture Group!

- North Carolina Nursery & Landscape Association announces new executive vice president

- Plant Development Services, Inc. unveils plant varieties debuting in 2025

- Promo kit available to celebrate first National Wave Day on May 3

- Applications now open for American Floral Endowment graduate scholarships

- Endless Summer Hydrangeas celebrates 20 years with community plantings

- Invest in silver

- Garden Center magazine announces dates for 2025 Garden Center Conference & Expo