_fmt.png)

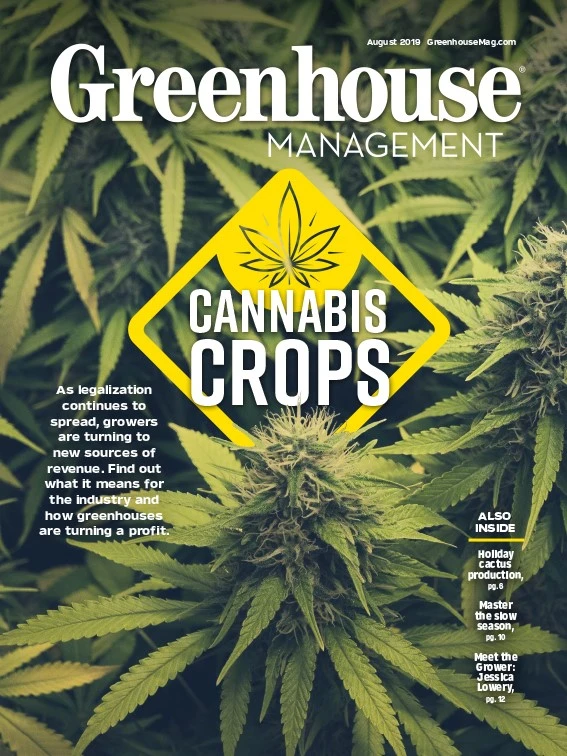

Facing competition from big box stores and cheaper imports — amidst shifting markets, unpredictable weather and inflating costs — greenhouse operators Brian Wheat and Bob Aykens are rethinking their business models. Both fourth-generation business owners, they’ve watched their predecessors adapt over time, but their families would have never guessed that their greenhouses would one day be filled with cannabis.

“One of the key lessons my father always told me is that diversification is key,” says Aykens, who owns Memorial Florists and Greenhouses in Appleton, Wisconsin, with his sister. “We’ve been around since 1923 because we’ve diversified from growing cut flowers to growing chrysanthemums and annuals, and now this is the next step.”

But learning how to grow a new plant can be a risky business fraught with trial and error — especially in the highly regulated cannabis industry. That’s why Wheat and Aykens decided to lease greenhouse space to hemp production, rather than entering the market themselves.

“Our greenhouses were in such disrepair and we were only generating income from three months out of the year, but we didn’t want to sell the land,” says Wheat, CEO and owner of Lafayette Florist, Gift Shop and Garden Center in Lafayette, Colorado. “Leasing seemed like a better option, because at least you’re pulling in rent money, generating some cashflow year-round.”

That doesn’t mean leasing to hemp is easy money. For every opportunity, there are obstacles to overcome, so Wheat and Aykens shared their advice for renting greenhouse space to cannabis.

_fmt.png)

Vetting partners

“For the last six years, people have been calling me about cannabis,” says Wheat, a master gardener and member of the Society of American Florists. “I wasn’t going to grow marijuana in my greenhouse — for security purposes, for reputation purposes, for a lot of different reasons. It just wasn’t the right fit for our family retail business in small downtown Lafayette.”

Then, Wheat started taking CBD oil for joint problems. Once he learned the difference between marijuana (which contains psychoactive THC) and hemp (which produces CBD), he recognized the crop’s potential. So, he was intrigued when a representative from Front Range Biosciences walked in one day and asked Wheat to meet with Jonathan Vaught, the company’s co-founder and CEO, about leasing some greenhouse space for hemp production.

Other hemp growers offered Wheat a percentage of profits after processing — and although those six-digit numbers were enticing, the uncertainties of sharecropping posed too many risks. Wheat wanted regular rent payments, but when he calculated his costs, the price even shocked him. However, Vaught understood greenhouse operating expenses, as he was already renting facilities across the country. Plus, Wheat’s business — located just two miles from FRB’s lab — offered a prime location, so Vaught even offered to renovate the space to meet his operation’s standards.

“We agreed on the length of the lease and the price per square foot — which, across the country, goes anywhere from $4 per square foot for a greenhouse that might need a lot of repair, all the way up to $10 per square foot if the greenhouse is in great condition,” says Wheat, who couldn’t share specific details, but emphasized that Vaught has been a wonderful partner.

Although rent payments and renovations sweetened the deal, these decisions should be based on due diligence, not just dollars.

“Right now, in the cannabis world, people are willing to invest significant money to retrofit a structure if it’s faster than building a new one,” Vaught says. “But beware of the hype. Vet your tenants and get to know them; make sure they’ve got strong financial models and business plans behind them. It’s a long-term deal, kind of like a marriage, so you don’t want to jump into it overnight. If you do your due diligence, you’ll be able to weed out the ones that aren’t going to be sustainable partnerships.”

_fmt.png)

Sharing space

Vaught’s renovations to Wheat’s greenhouse included new lighting, environmental controls and security systems with locks and cameras — which ended up benefitting the rest of Wheat’s business.

“Now I can see what’s going on and control the boiler, the air conditioning and the vents from my phone, even when I’m not there,” Wheat says.

But inviting another business into your greenhouse requires careful consideration. When Wheat called his mother to share the news of his tenants — which initially included two other hemp growers in addition to FRB — her first comment was, “You don’t have enough bathrooms.” Six months later, Wheat realized she was right.

Although FRB only brought in six employees, Wheat’s other hemp tenants had as many as 75 people on the property, in addition to Wheat’s 26 employees — which strained the parking situation, the break room capacity and the facility’s four restrooms.

Splitting up energy costs was an even bigger hurdle, since Lafayette Florist only has a single utility meter.

“I had to sit down with the tenants and say, ‘If you aren’t going to put in your own meter so we know exactly how much gas, water and electricity you used, you’ll have to agree with our assessment,’” Wheat says. “People can get angry about their share of energy costs, so you better come up with a plan before you go down this path.”

Educating the community

When Wheat started leasing to FRB, an elderly customer who’d been shopping with him for several decades quickly shared her disapproval.

“She poked me in the chest and said, ‘You sold out to the devil’s cabbage,’” he recalls. “She was mad because she couldn’t go into the greenhouses where we used to keep 20,000 geraniums. I tried to explain that we’re helping our family business survive. I could have sold the land and bulldozed the greenhouses, but I didn’t do that.”

Overall, the pushback from customers has been minimal, because Wheat made deliberate efforts to educate the community about the new crop on his property and why he decided to lease space to hemp production.

“It’s vital for anybody who’s thinking about doing this to be totally open and honest with your employees and your customers, because if you’re secretive, then they think you’re hiding something,” says Wheat, who crafted an explanation letter (available at here).

_fmt.png)

Early on, Wheat also met with the city manager and chief of police to preempt any concerns. They asked him to install shade curtains to mitigate night-time lighting that might bother the neighbors. In terms of regulatory requirements, FRB held the necessary hemp licenses, which reduces the burden for their greenhouse landlords.

Aykens agrees that transparency is key. “You have two options: You can keep it quiet or be vocal about it,” he says. “We got ahold of the media and hosted a hemp lunch-and-learn, and it created a huge buzz in the community. The key was educating the consumer that hemp does not have THC. That took away a lot of the stigma.”

Memorial Florists used to grow 60% of its plant material, so when Aykens began entertaining this idea, he met with key growers who supplied the rest to ask if they could make up the difference. That means “customers haven’t seen a difference in quality,” he says. “Instead of having hundreds of each variety of coleus, we’ve got maybe 20 on-hand at a time.”

If customers balk at the limited selection, Wheat offers to pick up special orders from growers. “We’ll go that extra mile because we don’t want our hemp rental business negatively impacting our customers,” he says.

_fmt.png)

Profiting from opportunity

For Aykens, the hardest part has been adjusting to the change of scenery in greenhouses once filled with colorful blooms, that have now become seas of hemp green.

“I’m used to walking in our growing facility and seeing color,” he says nostalgically. “But we’re in business because we need to be profitable. We need to make sure that the people who work for us have good jobs, and that means we’ve got to have a good bottom line.”

Thanks to hemp, he’s now seeing green in more ways than one. “We’ve become more profitable as a company and our bottom line has changed substantially because of it,” he says.

Of course, operators must weigh the pros and cons that hemp rental can have on their facilities and their reputation. For vexed greenhouse owners like Wheat, year-round leasing “helps cashflow in slow retail times” by generating income from structures that sat empty.

“If you operate with the right amount of caution, it can be incredibly lucrative,” Vaught says. “There’s a good opportunity to monetize your property through the right partnerships.”

Explore the August 2019 Issue

Check out more from this issue and find your next story to read.

Latest from Greenhouse Management

- Anthura acquires Bromelia assets from Corn. Bak in Netherlands

- Top 10 stories for National Poinsettia Day

- Langendoen Mechanical hosts open house to showcase new greenhouse build

- Conor Foy joins EHR's national sales team

- Pantone announces its 2026 Color of the Year

- Syngenta granted federal registration for Trefinti nematicide/fungicide in ornamental market

- A legacy of influence

- HILA 2025 video highlights: John Gaydos of Proven Winners