K-Coe Isom is AmericanHort’s partner law firm and specializes in agricultural law and consulting. Kala Jenkins, one of the firm’s agricultural specialists, discusses how the recently passed Paycheck Protection Program Flexibility Act of 2020 has changed from previous PPP models and what it offers green industries.

Greenhouse Management: What should business owners know about what this legislation can offer them?

Kala Jenkins: What this is primarily helping business owners do is provide payroll. That’s the biggest thing I consider when I look at PPP. To be able to give yourself that income source to maintain your payroll and labor source for your operation is what this is all about. That’s two-fold too. It’s to keep your doors open, but [it’s] really about helping your employees be able to withstand the economic changes that we are all going through and that are impacting businesses. You’re not only protecting your business, but you are also protecting your employees. The other thing to know about PPP is that [it] allows you to pay a couple of expenses like your mortgage interest, some utilities and rent/leases that are also eligible to be paid via this act.

GM: What are some of the notable changes made to PPP in the recent legislation?

KJ: Under the old law, your loan terms were a minimum of two years for funds that were not forgiven. Under the new law, that’s now a five-year term. However, within that, you have to look it from your PPP loan approval dates. So if you had a loan prior to June 5, you have that ability to stick to that term or go back and renegotiate with a lender to go out five years for funds that are not forgiven. Any loan approved after June 5 is an automatic five-year window. ... One thing that isn’t clear right now is if transportation costs can be covered by PPP.

GM: Do growers need a third party to help guide them through this process?

KJ: I do think it’s good to have a third party walk you through this, especially because of all of the changes that are going on with the PPP program. For a while, we used to get updates from the [Small Business Association] daily or every other day detailing changes. That started with the application process and now it’s extended to the forgiveness process. Instead of you having to know the rules and regulations and what’s required, I think it’d be a good idea to have somebody else who is very knowledgeable with the program and understands its ins and outs so you can take that risk off of your plate. You may also have some lenders who take that third-party help as a good sign and potentially have it result in a quicker process for forgiveness or in the application process.

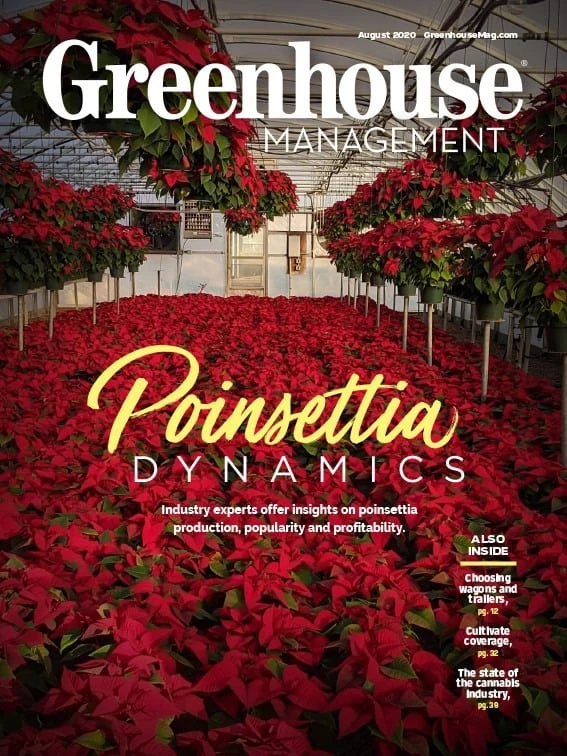

Explore the August 2020 Issue

Check out more from this issue and find your next story to read.

Latest from Greenhouse Management

- These companies are utilizing plastic alternatives to reduce horticultural waste

- Terra Nova releases new echinacea variety, 'Fringe Festival'

- AmericanHort expands greenhouse training with new Section Grower Certification

- Sakata Seed America celebrates renovation of Cal Poly greenhouse complex

- American Horticultural Society names winners of 2025 AHS Book Awards

- Nufarm announces unified brand

- American Horticultural Society announces winners of 2025 Great American Gardeners Awards

- What growers can learn from amateur plant scientists