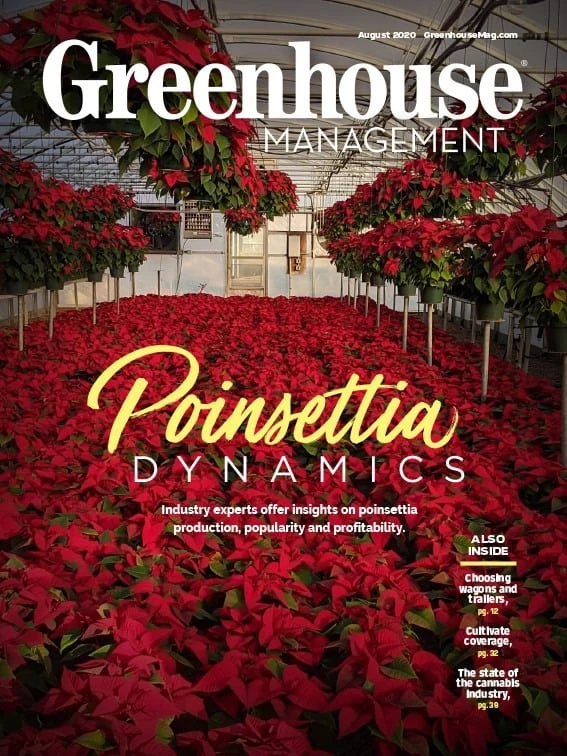

Though poinsettias hold the lead in units sold, there was a time they topped the list for wholesale dollars as well. Today’s poinsettias are more compact, more resilient, more colorful and more diverse than ever, but the market has changed as well. Whether poinsettias are on your production schedule or not, these insights can benefit your operation in the days ahead.

Shifts in growers and goals

North Carolina State University’s Dr. John Dole has worked with poinsettias and poinsettia growers for nearly 40 years. An avid poinsettia lover, he helped bring poinsettia production secrets to the forefront for growers nationwide. He recalls advances in grafting, PGRs and genetics that set the stage for poinsettia glory years in the 1980s — and the market saturation that followed in the 2000s.

Since that time, Dole has watched poinsettia production plateau as significant shifts take place. “What we’ve seen is a big decrease in the number of people growing poinsettias, while the number of poinsettias grown has stayed fairly flat. We just see ever-larger production places doing more. More production per grower, fewer growers,” he says.

With this shift, Dole notes two schools of thought regarding poinsettia crops. One side leans toward just covering expenses and using poinsettias to keep labor around for spring bedding plant season. “The other school says if the crop doesn’t make money, you’re better to shut the greenhouse down,” he says. “Most growers are in between — able to keep going and making more than they could otherwise at that time and season.”

For various reasons, many smaller growers have dropped poinsettias. After 35 years of poinsettia production, 2019 marked the last poinsettia season for North Carolina grower John Weddington Greenhouse. Father and son co-owners John and Kurt Weddington say the decision was driven more by the crop’s demands and desire for more family time.

“It’s a time-consuming, very unforgiving crop. You have to be with them daily,” John Weddington says. With 6-year-old triplets, Kurt Weddington says something had to give. Rather than 11,000 florist-quality poinsettias this year, the Weddingtons’ production plans include a less time-consuming, less-demanding mix of fall mums and strawberries.

Even so, the pair wasn’t immune to industry pressures as loss-leader poinsettias became Black Friday specials at box stores. “That’s not our reason for stopping. I never competed with that,” John Weddington says. “But when someone can sell poinsettias at Black Friday pricing for less than I can buy a cutting, something is out of order.”

Market changes and challenges

Known for their annual poinsettia trials and open house, Illinois-based N.G. Heimos Greenhouses has been growing poinsettias since 1952. The crop now comprises about 35 acres of Heimos’s annual production, which translates to roughly 1.5 million poinsettias.

Head grower Amy Morris recalls the company’s decision about 17 years ago to move away from box stores, which accounted for 40 to 50% of their business at the time. “[The box store] went to pay-by-scan at the time and we were dumping way too much because we didn’t have control of how things went into the stores,” she says. “We just decided it would be better for our company if we went back to the basics and simple.”

It turned out to be a good move. New customers migrated to them, on Heimos’s terms. “We were able to be successful and keep growing and expanding,” Morris says.

I feel that a lot of consumers, like myself, have gone back to basics — back to grandma, grandpa, mom and pop. I’m curious if consumers are going to go back to the old, traditional, standard red poinsettia instead of some of the different types of poinsettias and novelties.” — Amy Morris, NG Heimos Greenhouses

Lisa Ambrosio, president of Wenke/Sunbelt Greenhouses, reflects on the decision to move poinsettia production out of Wenke’s Michigan greenhouses to their Georgia Sunbelt greenhouses more than a decade ago. Faced with rising labor and utility costs in the cold climate, the move made economic sense. “It came down to we were putting more cost into it than what we had in a revenue opportunity,” she says.

For 2020, Sunbelt greenhouses will have about 8 acres in poinsettias, with a core crop of about 100,000 plants. Ironically, southern warming trends are now a concern. “It’s a tricky crop and there’s no margin for error,” Ambrosio says. “It is just substantially hotter in the South during October and November than what it has been in the past. That has a huge impact on how the crop grows and what we need to do to produce it.”

The Weddingtons observed another important market shift. As with many poinsettia growers, fundraisers represent a critical segment of their sales — especially church fundraisers aimed at older demographics. “We made money on poinsettias and we had a lot of very loyal customers, but that clientele aged out,” John Weddington says.

Kurt Weddington believes that younger consumers haven’t yet connected to florist-quality poinsettias. “When loss-leaders started appearing on Black Friday, poinsettias were everywhere,” he says. “It wasn’t quite as special. It became more of a commodity crop.”

Trends in popularity and preferences

Dole sees the boon in cultivars as one of the most significant changes in the poinsettia market. New cultivars are now less about major changes and more about subtlety, he says. He reports steadily increasing interest in combination planters. (He recommends growing your poinsettias separately, then dropping them into waiting pots in your combination planters.)

Painting, once considered a fleeting trend, has gained traction.

“Painting has become part of the norm,” Dole says.”Painting, glitter, any of the coloring or decorative stuff applied directly to the plant, that’s here to stay.”

And color? “This is tough for me to say, as somebody who evaluates cultivars, but it’s still all about red,” he says. “It’s a much darker red. The foliage is darker, the leaves last longer. It’s a different red than it used to be, but it’s still very much red.”

Morris has 181 varieties in the Heimos trials this year, plus 151 varieties on private breeder trials. Due to COVID-19 and limits on gatherings, she’s unsure how the trials and open house will play out, but she’s eager to see consumer choices.

“I feel that a lot of consumers, like myself, have gone back to basics — back to grandma, grandpa, mom and pop,” Morris says. “I’m curious if consumers are going to go back to the old, traditional, standard red poinsettia instead of some of the different types of poinsettias and novelties.”

Beyond new cultivars, Morris agrees painted poinsettias are still on the upswing. At Heimos, spray paint and glitter go on in every color — even rainbows. “We painted about 30 to 40 thousand poinsettias last year, which was up about 10% from the year prior. That just keeps growing for us,” she says.

What we've seen is a big decrease in the number of people growing poinsettias, while the number of poinsettias grown has stayed fairly flat." — Dr. John Dole, NCSU

Wenke/Sunbelt doesn’t paint or glitter poinsettias, but novelty varieties and unique colors lead the way. “We are really focused on garden centers and fundraisers,” Ambrosio says. “Our customers are looking for something a little different to separate them from the competition. They have a different type of customer that comes to the store, looking for something a little different than what they would find in the mass market.” Shelf life is especially important.

Some of Sunbelt’s most popular cultivars include Jingle Bell types and red-and-white speckled cultivars. The Princettia series, especially the whites, have been big sellers. “That’s not because of the color, but the shape of the leaf, the way it looks and that it holds up for a really long time,” she says.

Opportunities vs. obstacles

Though Dole declares he’s “a production guy,” he believes that marketing holds the biggest opportunities for poinsettia growers. Interestingly, he says it also represents the biggest obstacle to overall market growth. Dole, who briefly worked at Ecke Ranch prior to his graduate school days, recalls how Ecke’s wildly successful marketing made poinsettias the Christmas flower, but also painted the crop into a corner. “What he did was make the poinsettia what it is today, but it came at a cost,” he says.

Doles points to opportunities to expand beyond the Christmas market. Examples include pink poinsettias for Valentine’s Day or October’s Breast Cancer Awareness Month and pumpkin-orange cultivars for Thanksgiving or even Halloween. But Dole suggests marketers may need to come up with a new plant name and save “poinsettia” strictly for the Christmas holiday.

Wenke/Sunbelt has had some success with orange for Thanksgiving, but southern heat diminishes demand. “If it’s 90 degrees, people just aren’t thinking about poinsettias,” Ambrosio says. Valentine’s Day promotions haven’t met with success. “There’s a perception that says a poinsettia is for this certain time of year and after that, [consumers] don’t want to see it again,” she says.

The Heimos team markets the Color of the Year heavily and does displays to show their customers how to market colorful poinsettias. “For the Year of the Blue, we did a blue poinsettia tree with Elvis Presley cutouts,” Morris says. The marketing efforts have had good response.

Heimos has done orange for Halloween for about 10 years. A white poinsettia painted with Thanksgiving colors, marketed as “Autumn Beauty,” is a regular. Novelty poinsettias timed to compete with Valentine’s Day roses also perform well for their market.

Productivity and profitability

For growers considering poinsettias, Dole stresses the importance of knowing your market. He suggests that trying to compete on cost is a doomed strategy. “It’s a fairly tight market in the sense that there’s not a lot of profits and there’s a lot of competition. For a newcomer to get into that, that’s not going to happen easily — even for a big grower of bedding plants.”

If your market wants and is willing to pay for something different — that you can provide — the outlook is much brighter. “The closer you are to the customer, the higher the prices you can get and the more flexibility you have on what you grow,” he says, noting profitable direct-retail sales by independent grower-retailers.

Capitalizing on advances is also key. “Growers are continuing to refine production and the breeders are as well. Now we’re seeing early cultivars that produce a really substantive plant in a short amount of time. Growing those cultivars and reducing the crop time gets you more greenhouse space to put something else in,” Dole says.

Other developments include cultivars that won’t require pinching or PGRs, or ones that tolerate tighter spacing, freeing up greenhouse space for other crops.

Morris acknowledges that poinsettias are challenging, but says growers should expect to be profitable: “If you’re doing this whole crop and not making any money, then you need to re-look at how you’re doing the crop and maybe re-look sales margins.”

She recommends staying ahead of the game on things such as insecticides, PGRs and fungicides. “Be proactive instead of reactive and chasing a problem. You might be able to save there,” she says. Mechanical pinching instead of hand pinching might yield savings as well.

“The thing that gets most growers right now is the cost of labor. That is one of our biggest issues and it’s our biggest cost,” she says. “You have to stay on point with your people and urge them to do everything as efficiently as possible.” And you have to stay on point yourself.

As someone who has grown poinsettias for decades, Morris offers growers this encouragement: “Be patient. Walk your crop. Be aware of the leaves and what the plant is telling you. … Go back to basics and make sure you’re not taking any shortcuts and, if you do, the crop’s going to be great.” Oh, and don’t forget to pull out your Ecke manual annually. Morris rereads hers every year.

Explore the August 2020 Issue

Check out more from this issue and find your next story to read.

Latest from Greenhouse Management

- Anthura acquires Bromelia assets from Corn. Bak in Netherlands

- Top 10 stories for National Poinsettia Day

- Langendoen Mechanical hosts open house to showcase new greenhouse build

- Conor Foy joins EHR's national sales team

- Pantone announces its 2026 Color of the Year

- Syngenta granted federal registration for Trefinti nematicide/fungicide in ornamental market

- A legacy of influence

- HILA 2025 video highlights: John Gaydos of Proven Winners